Property taxes are levied by the Township for all properties within its boundaries and provide the main source of revenue to deliver services supplied by the municipality. In addition to collecting its own taxes, the Township is also responsible for levying and collecting education taxes on behalf of the Province of Ontario, which are distributed to school boards located in the Township, as well as on behalf of the County of Lanark.

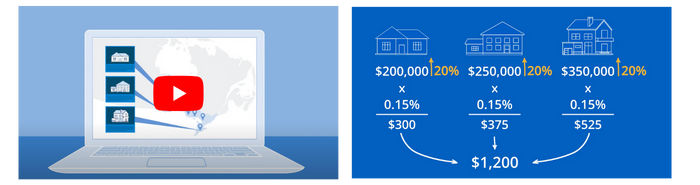

How Property Taxes are Calculated

To help provide clarity for property owners on how property taxes are calculated, including the link between property assessment, municipal service costs and required tax dollars, watch MPAC’s helpful and informative new video.

Property Tax eBilling

Please complete this form if you wish to receive your tax bills by email. It's convenient and paperless.

Preauthorized Payment Plan

Arrange monthly withdrawals from your bank account to be applied against your tax account. Your tax account must be up to date before you begin. You will still receive a property tax bill for your records.

| Tax Due Dates |

|

Tax bills are issued in January and June. If you have not received your tax bill by the 15th of February or July, please contact the Municipal Office. 2026 Due Dates

|

| Tax Payment Options |

|

Payments may be made by any one of the following methods:

|

| Receipts |

| If a receipt is required, when mailing your payment, please include the entire bill and a self-addressed, stamped return envelope. |

| Additional/Supplementary Tax Bills |

| You may receive additional or supplementary tax bills if there have been changes to your assessment (ex. new house, renovations, demolitions, tax class and tax qualifier changes, assessment appeals, errors and omissions, etc.) |

| Reprinting a Tax Bill/Tax Statement |

| A fee of $10 will be charged for a tax statement reprint of a tax bill. Please keep your bill in a safe place as you may require it for income tax purposes. |

|

Other Currencies |

|

Payments made other than in Canadian Funds will be applied against taxes owing at the exchange rate applicable on the day of receipt less a $5.00 bank service charge. |

|

NSF Cheques |

|

NSF or any returned cheques are subject to an administration fee of $35.00. |

|

Overdue Accounts |

|

A late payment charge of 1.25% on the total taxes owing will be added on the first day of the month following the due date and on the first day of each month thereafter until paid. All subsequent payments are applied to interest charges first, then to outstanding taxes. |

|

Changes to Municipal Legislation |

|

Effective January 1, 2019, tax accounts in arrears in excess of two years will now be subject to Tax Registration/Tax Sale process. Please contact the Finance Department to make payment arrangements. |

|

Payments through Mortgage Companies |

|

If a Mortgage Company pays your taxes, the tax bill will be sent to the Mortgage Company and a copy will be sent to you. |

Please notify the Municipal Office as soon as possible if there is a change of address. Change of Address can be completed on our website, please complete the appropriate form(s). Change of Address cannot be done over the phone.

Change of Mailing Address Form Change of Email Address Form

Failure to receive a tax bill will not invalidate penalty and interest charges.